Autumn 2024: Prime London overview

SEARCHING FOR CLARITY

2024 is seen by many as potentially a pivotal year for prime London property. It marks a decade since the last market peak, with prices having effectively flatlined since then. It is the year when painfully high interest rates have commenced a downward trend. And it has drawn a line under 14 occasionally chaotic years of Tory government, with the baton handed on to a left-of-centre administration.

July’s surprise election provided some clarity on the political situation; the new Labour government has a formidable majority and a pretty broad coalition – from unions to business leaders – behind it. August saw the eagerly anticipated first cut in base rates from the high of 5.25%, and the outlook for one or two more cuts before the new year is promising. One date looms large in the calendar, however. On 30 October we will have the first Labour Budget for nearly 15 years. This will throw much light on how the new government, with its vast majority, intends to achieve its boilerplate objectives of “growing the economy, reducing debt, and fixing key public services”.

THE TORY LEGACY

For those fearful of the potential for a ‘left-wing’ government meddling with the free market, I would point out that we have just said goodbye to a ‘right-wing’ government which made extraordinary moves to change the way the market operates. Under the Conservatives Stamp Duty multiplied, incentives for private landlords to invest and help improve stock levels were removed, and a policy to disincentivises second home/buy-to-let ownership was enacted – with stringent tax changes introduced. Foreign buyers were particularly discouraged through higher taxation and the abolition of key fiscal exemptions. Meanwhile, subsidies for lower-value buyers through the likes of help-to-buy and Stamp Duty holidays were turned on and off. Layer upon layer of regulations were imposed on landlords and agents, further decelerating the buy-to-let sector. Meanwhile, the urgent need to create affordable new homes was entirely avoided, as the Ministry of Housing & Local Government answered to the misgivings of every NIMBY in the land. To illustrate just how serious and focused the Tories were about arguably the most important topic in domestic politics, bar perhaps the NHS, 16 different housing ministers were appointed during their 14-year term.

LABOUR’S KEY PLANS

The first key actions by the new government are straight out of their standard playbook. First is to abolish the ‘non dom’ status that has been in place for over 200 years. Close behind is the Leasehold & Freehold Reform Bill, giving leaseholders greater rights to extend their leases and mitigate the costs in doing so. Third will be a Renters’ Rights Bill which offers tenants greater protection and makes it harder for landlords to take their properties back as they please. But wait – these were all Tory-devised policies, only now being enacted by Labour!

NON DOMS – Changes from 6 April 2025

This long-standing ‘benefit’ is to be removed. The changes are mildly complicated, but in essence, any long-term resident in the UK, whether born or proven to have been long-term resident overseas, will become fully liable for tax on overseas earnings and exposed in full to Inheritance Tax if they stay in the UK for more than 90 days a year. The measure removes a draw for the super wealthy to base themselves in the UK, and it encourages the globally outward-looking to relocate to low-tax environments such as Dubai, Switzerland and Singapore, or countries eager to attract UHNWs with lower taxation regimes, such as Italy and Portugal.

LEASEHOLDERS – The Leasehold & Freehold Reform Bill

Distinct from renters, the UK property ownership system means that all apartments are leasehold. We do not have condominium law or strata title as a rule. Buyers of new-build schemes will be used to purchasing 999-year leases, often accompanied with a share of the freehold. However, many of the most valuable parts of London (Mayfair, Knightsbridge, Regents Park) will often have leases well under 100 years and may be part of a large, single freeholder-owned estate (Cadogan, Grosvenor, Crown, etc).

The political desire on both sides is to move more towards a ‘commonhold’ system where all ‘leaseholders’ automatically share the ownership of the freehold and determine how it is managed. This is a fine aspiration but the practicality is far from simple. There is a big difference between a 150-unit block in central Manchester and a five-unit converted house on the Grosvenor Estate in Belgravia and many variations in between.

Ultimately these changes are likely to prove a positive and for future investors and existing homeowners there is little material downside. The pain is to be felt most acutely by the aforementioned large freehold estates.

RENTERS – Renters’ Rights Bill

This Bill is still going through Parliament and then the Lords to be ratified. Renters are to get more rights and these are best simply summarised as follows:

– Fixed terms are to be abolished and tenants will be free to give notice (probably 60 days after 4 months) at any time.

– Removal of Section 21 notices. These are legal instruments a landlord would use to obtain vacant possession at any point, once the terms of the specific tenancy agreement allowed.

– Abolition of competitive bidding and rent ‘gazumping’. Basically once an offer has been accepted, others cannot be entertained.

– Rent increases must be in line with the market rate.

– Greater protection for tenants against properties in poor repair.

– Changes to certain tenant restrictions, such as ‘no pets’ clauses.

LANDLORDS – Renters’ Rights Bill

Landlords are to have less flexibility, as follows:

– No ability to secure long-term commitments (minimum one or two years, etc.)

– Tight rules on eviction. Acceptable reasons would be desire to sell, need for own/family immediate use, non-payment of rent, breach of tenancy agreement.

– Ability to achieve premium uplifts on renewal will be contained and linked to ‘market’.

The Bill’s primary motive is to protect long-term tenants from rogue landlords. In reviewing our own portfolio, bearing in mind our tenant profile is almost entirely international and few very long term tenants , we assess that fewer than half a dozen cases in the past 10 years would have been at all contentious. One of these rare examples was a Dutch tenant who lived in the same apartment for 18 years. Periodically his rent would slip below market, so every five years or so we had a tough negotiation to increase it. The chances are this would have been fine under the new rules – but if there were a dispute and the Property Ombudsman became involved, they would always take a tenant’s side. In practice most renewals stick pretty close to RPI, which negates any argument of unfairness.

The biggest negative we foresee is most likely to be the inability to bind tenants to long-term contracts. Plus, while we have been able to maximise rental premiums for our clients in a strong landlord market over the past 18 months or so, our ability to do this in future will probably be restricted, since encouraging competitive bidding falls foul of the new rules. Obtaining vacant possession will require more thought, but landlords looking to sell or pass their properties on to children should have no worries here. And we have zero concern about obligations to maintain properties to the right standards, as this has always been at the core of our service!

THE PLANNING CONUNDRUM

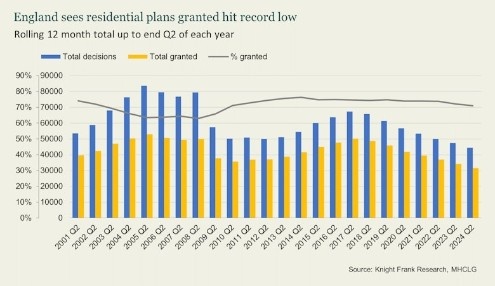

The Tories pledged to build 300,000 new homes a year and failed miserably. Labour is effectively promising the same (1.5 million in five years) but intends to ride roughshod over the traditional Tory-voting shires and areas of greenbelt (parts of which which it now refers to as ‘greybelt’). Meanwhile, the planning process remains likely to stymy all best intentions. In its most recent report, being more relevant to our area of focus, Molior, a company which tracks the new build market forensically, notes that just 54 new schemes were approved at planning stage across Greater London in H1 2024, which compares with 122 for the same period 10 years ago.

For prime London the pace of sales in high-end new-build schemes has become near-glacial. Near our office at the western edge of Chelsea, an entire tower has been mothballed for well over a year now. Against the grain, the trend for super high-end branded schemes (typically connected to or serviced by a five-star hotel) continue to do well. What was bread and butter to the developers (£1m-£3m apartments), having sold so well to overseas and buy to let investors, have since been clobbered by punitive tax changes designed to deter second-home or foreign ownership. Domestic demand is beginning to take up this slack, but it won’t all happen overnight.

Data on new schemes in London clearly shows a dramatic drop-off in the future pipeline. Even with the demand from overseas discouraged, supply looks likely to become tighter in the years ahead – which bodes well for the mothballed tower block near us, but down the line it implies a return to strong upward pressure on prices. Another area to watch is the very central rental market, with so many BTL investors exiting as they take their profits from the last 10-20 years’ growth, these are not currently being replaced by other investor-buyers.

THE GLOBAL PICTURE

One can clearly track many of the UK’s problems back to 2016 and the Brexit referendum. Prior to this the country had already been more deeply impacted by the global financial crisis than others in the G7. Eight years on from the shock of the referendum, we find the story confused at best. From an economic perspective, depending on how you like to cook your statistics, the UK economy is the best Europe-zone performer (currently), the worst performer (over the past decade), or mirrors Europe (over the mid-term). Politically Europe is veering right (and Europe tends to do ‘real’ right-wing – not our wishy-washy centrist right), while the UK has just turned left. Meanwhile, for the first time in my memory, the most prominent and powerful leader in Europe is the Italian Prime Minister and the weakest is a toss-up between the German Chancellor and the French President. While all this plays out, the economy which is really going gangbusters (and building the largest army) is Poland.

Across Europe and across the developed world there remain important issues that all politicians must grapple with. Unprecedented levels of debt. Ageing populations. Falling productivity. The political answer to this in many places is extreme populism or autocracy, leading to a retreat from globalisation and rising protectionism.

Property plays a big part in this as it highlights the disparity between the haves and have-nots perhaps better than anything. The UK is not alone in having to accept it as both a political issue and a political tool. Indeed, the ideals of a property-owning democracy are more complex to satisfy than ever – but the fundamental arguments still apply. So while some are busily moving their wealth away to other parts of the world, we also see money arriving from the other direction. And of course we instinctively know that the grass elsewhere is rarely quite as lush as it might appear, so we will happily stick with the green, green lawns of home.

STRATEGIES FOR A CHANGING WORLD

Amid all the current uncertainties, we are having many discussions with existing property owners and their advisors, who are looking for clear strategic guidance in considering their London properties and future objectives.

In understanding whether to sell, enhance, reposition, re-finance or restructure, there are both short- and long-term options. More often than not, multiple areas of input are needed – from rental and sales values (including realistic future projections) and costs to improve or maintain, to tax mitigation/planning (income, capital gains & inheritance), estate planning/structure, domiciles, etc.

Since UHNW owners are so internationally mobile, and given the changes this new government may herald, some are currently contemplating relocation – albeit for a limited period, as opposed to a ‘one-way ticket’. Retaining their London properties is likely to be a prudent choice for most, however. With the Stamp Duty penalty already priced-in, existing owners are well placed to see returns improve in the years ahead.

At Obbard our business is to review, assess, and set out clear strategies for clients – working alongside their key advisors, and ensuring their objectives are met and exceeded. Our unique operating model means that all the practicalities are managed under one roof by an integrated team set up to create value at every step of the relationship.

We always want to meet as many of our clients as possible on their own turf. We have just returned from a road trip to Jersey – and will be in Dubai in early November. And as ever, we will be visiting Hong Kong and Singapore in February. Do get in touch if you’d like to connect.